excise tax rate nc

The tax rate is one dollar. This Article applies to every person conveying an interest in real estate located in North Carolina other than a governmental unit or an.

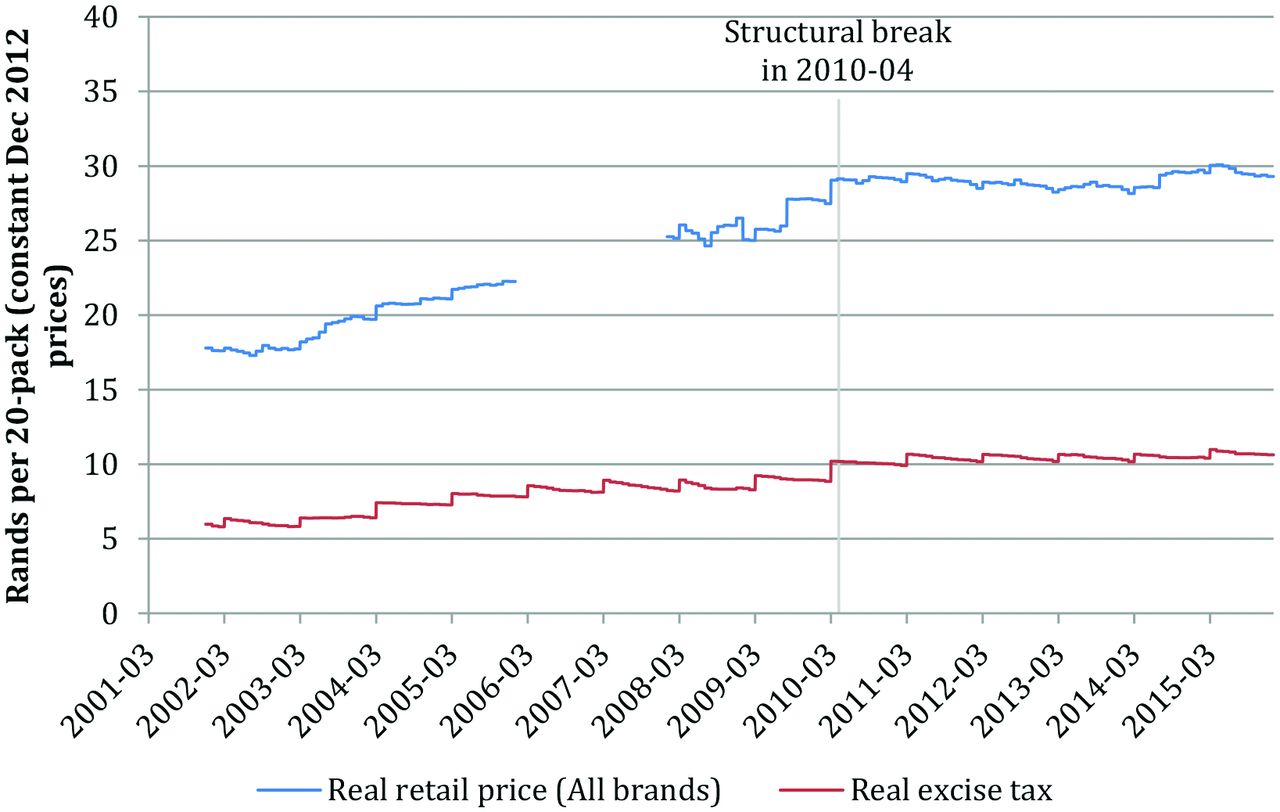

Contributions Of Excise Tax And Other Taxes To The Total Cost Per Pack Download Scientific Diagram

An excise tax is levied on each instrument by which any interest in real property is conveyed to.

. Revenue from the highway-use tax goes to the North Carolina Highway Trust Fund and the North Carolinas General Fund and is earmarked for road improvements. The state sales tax rate in North Carolina for tax year 2015 was 475 percent. Easily calculate the North Carolina title insurance rates and North Carolina property transfer tax.

2022 North Carolina state use tax. 2016 Piped Natural Gas Tax Technical Bulletin. When ownership in North Carolina real estate is transferred an excise tax of 1 per 500 is levied on the value of the property.

This title insurance calculator will also. Ad Avalara excise tax solutions take the headache out of rate determination and compliance. Ad Avalara excise tax solutions take the headache out of rate determination and compliance.

A single-family home with a value of 200000. The NC use tax only applies to certain purchases. Avalara solutions can help you determine excise tax and sales tax with greater accuracy.

North Carolina Wine Tax - 100 gallon. In North Carolina wine vendors are responsible for paying a state. How Do You Calculate NCs Excise Tax.

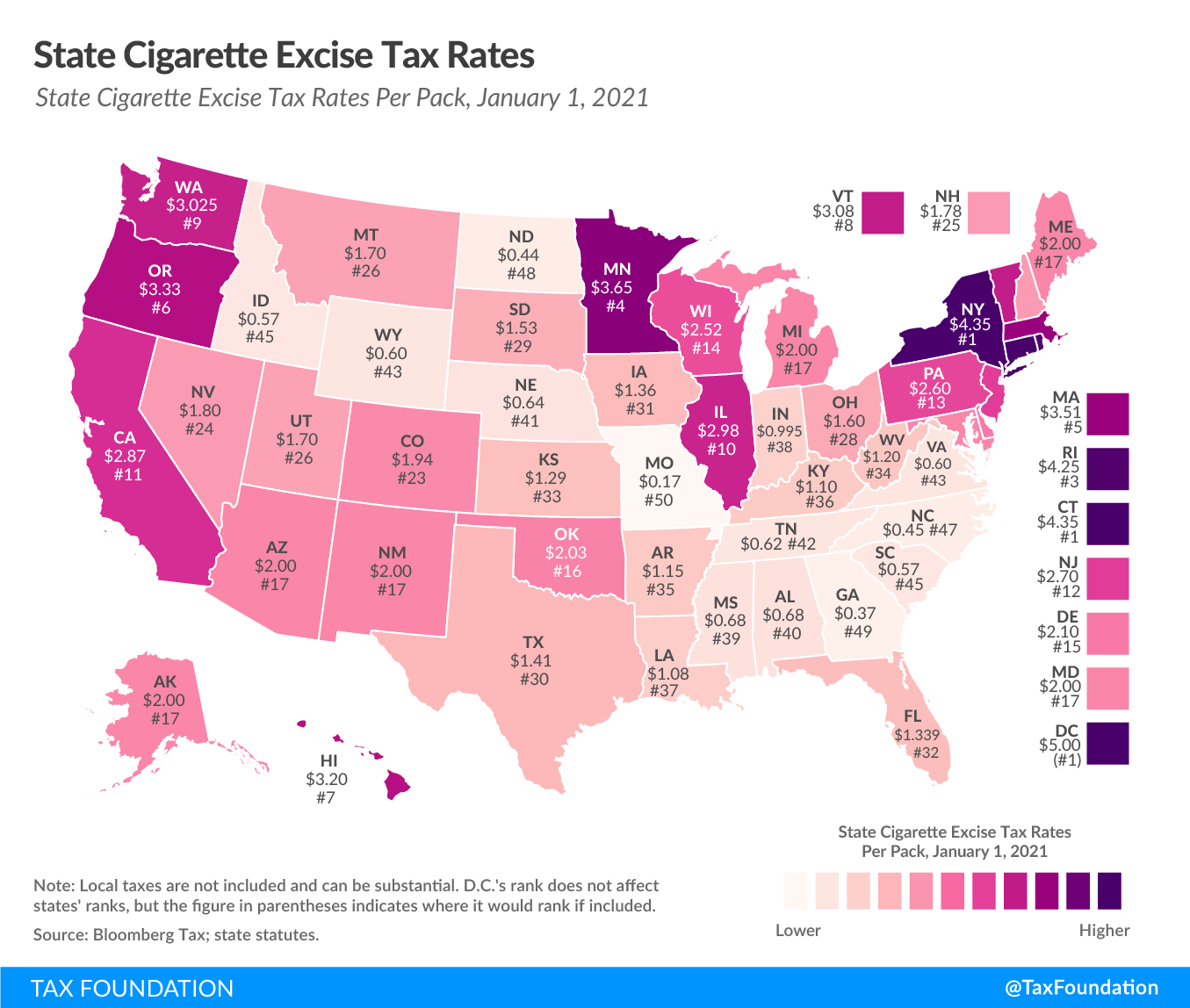

2016 Alcoholic Beverages Tax Tehcnical Bulletin. The primary excise taxes on tobacco in North Carolina are on cigarettes though many states also have taxes on other tobacco products like cigars snuff or e-cigarettesThe tax on cigarettes is. The table below summarizes state sales tax rates for North Carolina and neighboring states in 2015.

WASHINGTON The Internal Revenue Service announced today that it has prescribed tax rates for 121 taxable substances that are subject to the Superfund chemical. Tennessee has a tax. For example a 500000 property would have a.

How much are transfer taxes in North Carolina. North Carolinas general sales tax of 475 also applies to the purchase of wine. Customarily called excise tax or revenue stamps.

2016 Privilege License Tax Technical Bulletin. A An excise tax is levied on each instrument by which any interest in real property is conveyed to another person. What is North Carolina excise tax.

The North Carolina use tax is a special excise tax assessed on property purchased for use in North. How to calculate taxes Tax rates are applied against each 100 in value to calculate taxes due. Excise Tax on Conveyances.

Appointments are recommended and walk-ins. GET THE LATEST INFORMATION Most Service Centers are now open to the public for walk-in traffic on a limited schedule. South Carolina has a tax of 5 of the manufacturers price.

The North Carolina real estate transfer tax rate is 1 on each 500 of the propertys value. The property is located in the City of. And the proposed cap would make excise taxes on cigars lower than they are in border states.

2013 nc tax expenditure database. Avalara solutions can help you determine excise tax and sales tax with greater accuracy. 2005 North Carolina Code - General Statutes Article 8E - Excise Tax on Conveyances.

Motor Fuels Taxes Diesel Technology Forum

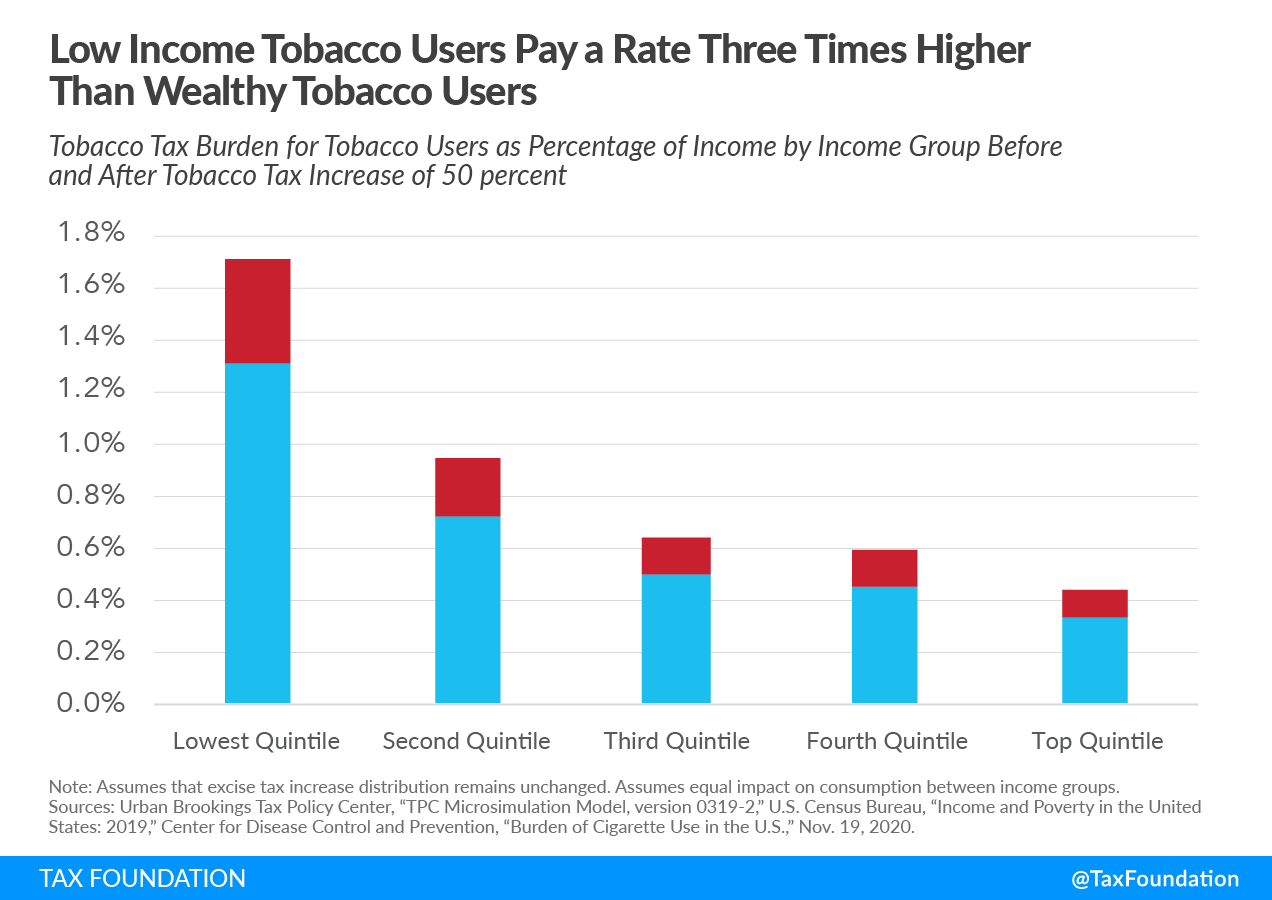

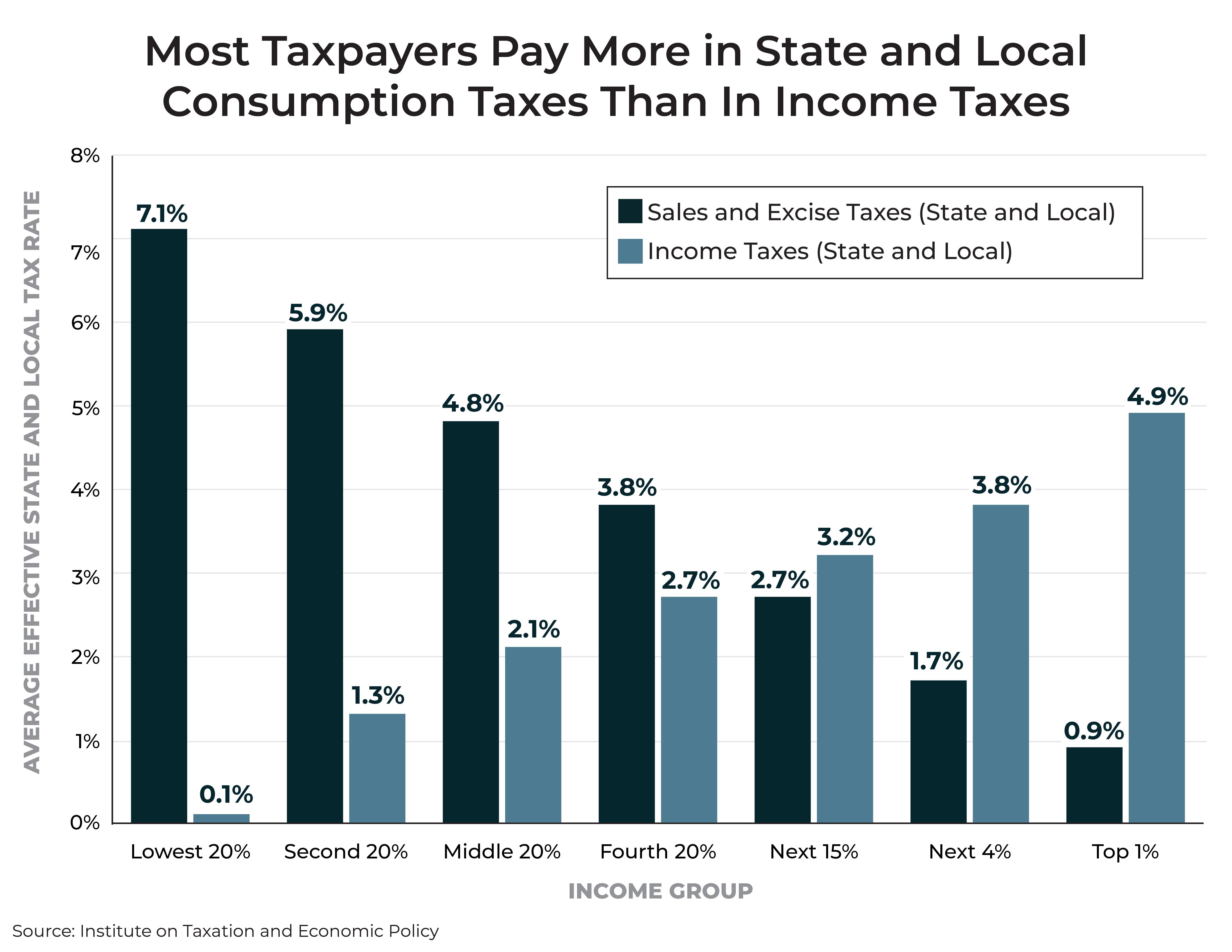

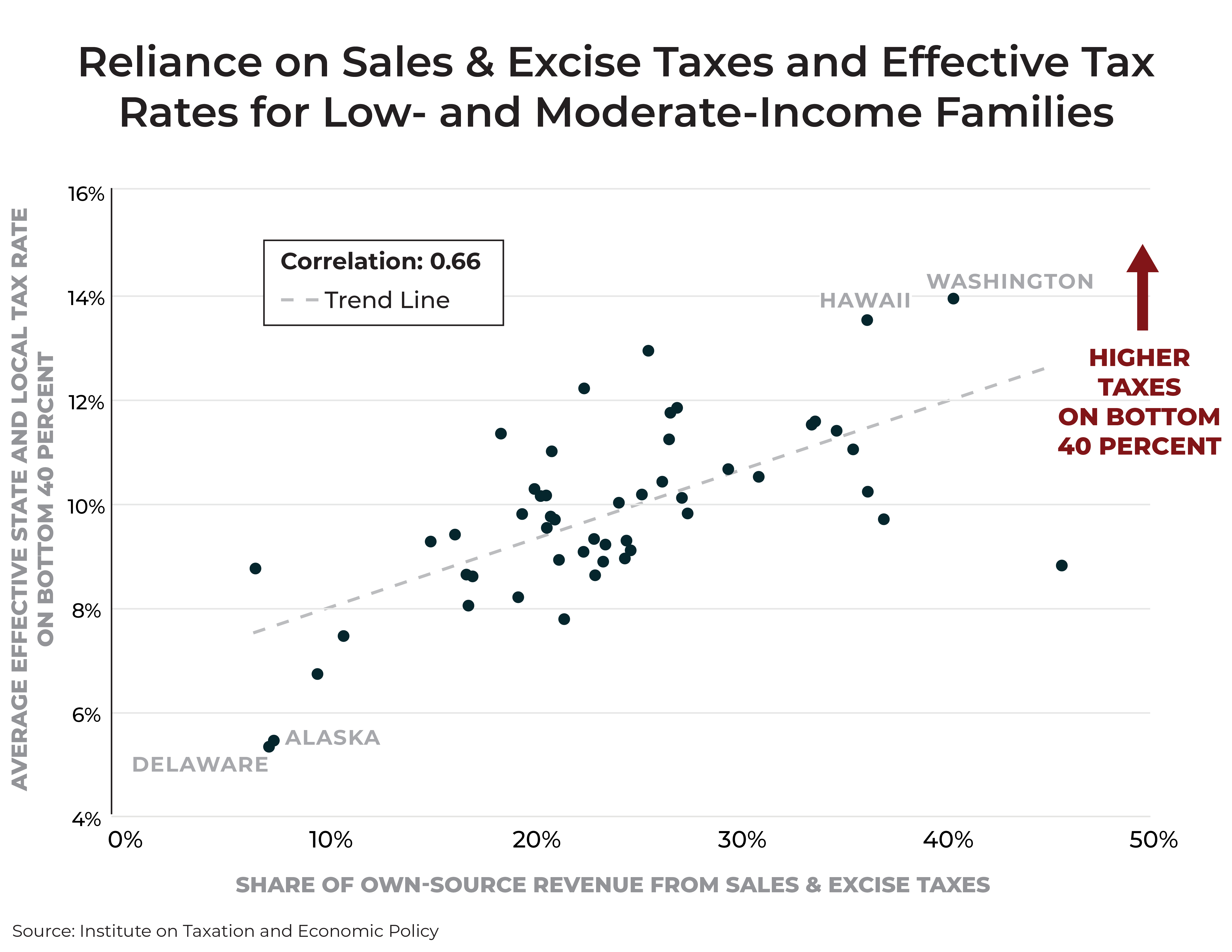

Fairness Matters A Chart Book On Who Pays State And Local Taxes Itep

New Tax On Chemicals In 2022 The Old Superfund Tax Is New Again

Wine Tax By State Easy To Read Wine Excise Tax Rates Map

An Unhappy Anniversary Federal Gas Tax Reaches 25 Years Of Stagnation Itep

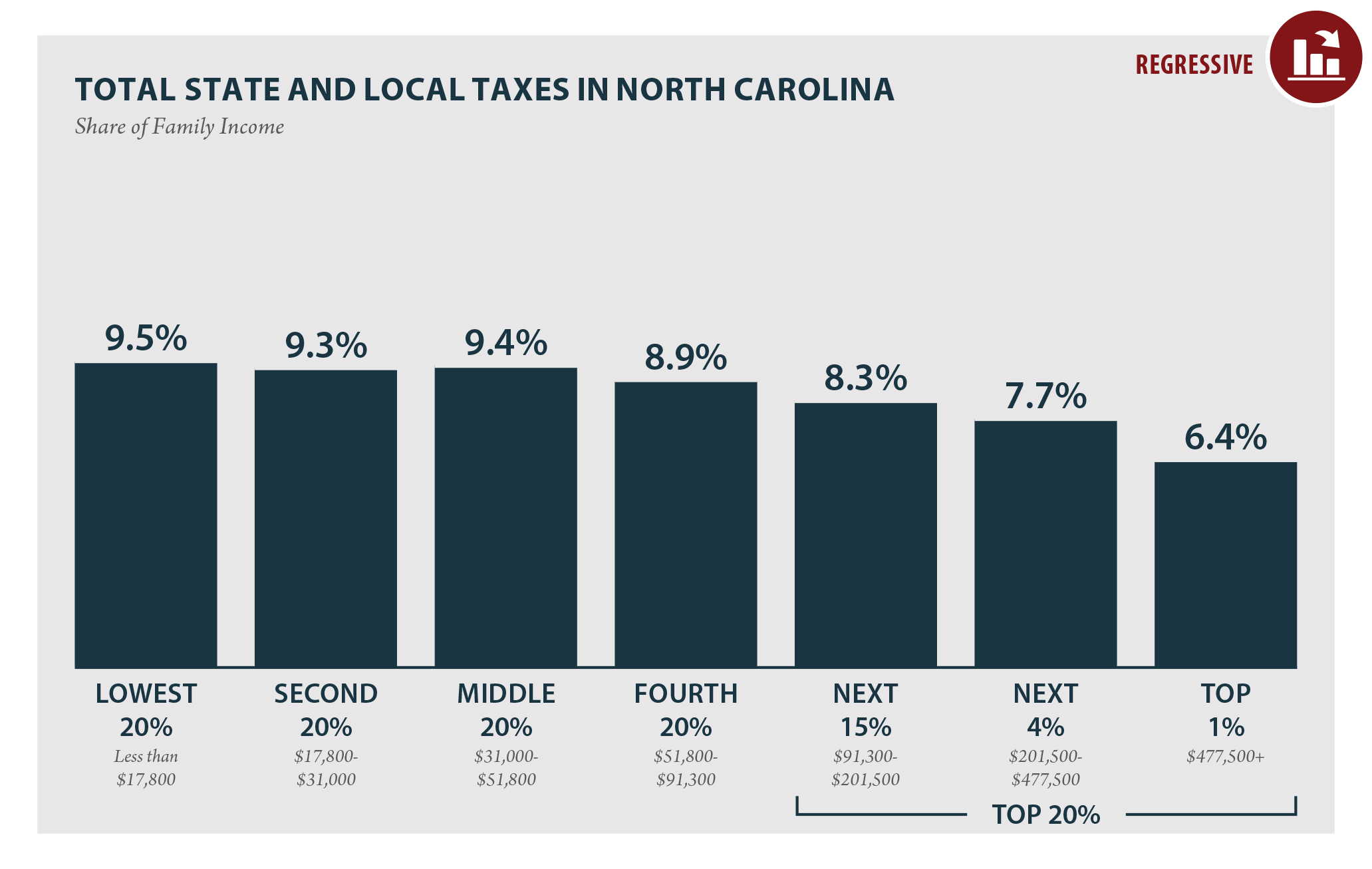

North Carolina Who Pays 6th Edition Itep

How To Calculate Excise Tax Real Estate S Ehrlich

North Carolina Cigarette And Tobacco Taxes For 2022

State Cigarette Excise Tax Rates United States April 2015 Download Scientific Diagram

Average Real Federal Excise Taxes In Dollars Per Barrel On Alcoholic Download Scientific Diagram

Historical North Carolina Tax Policy Information Ballotpedia

The Effect Of Excise Tax Increases On Cigarette Prices In South Africa Tobacco Control

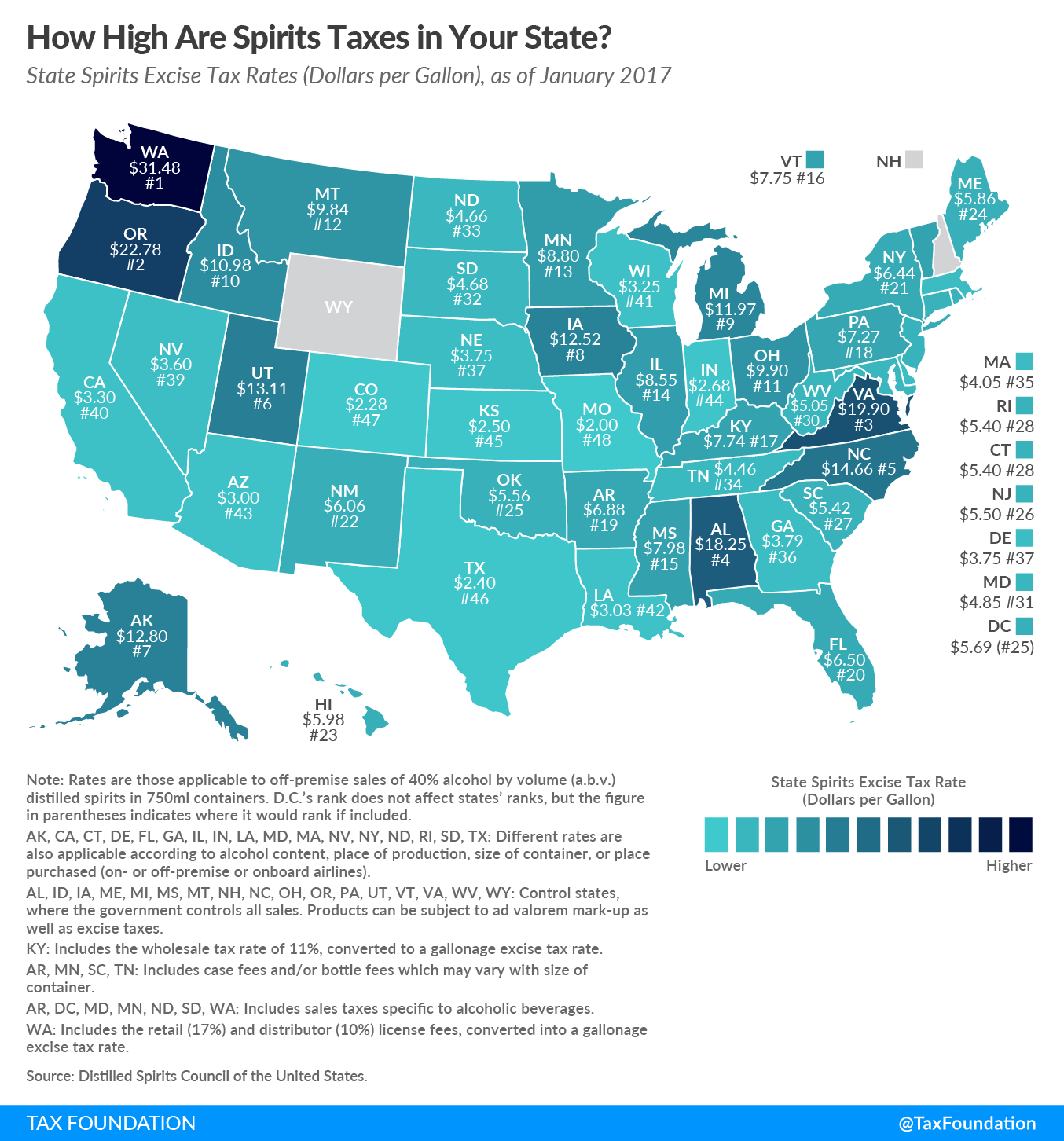

N C Excise Tax On Spirits Nation S Fifth Highest

Fairness Matters A Chart Book On Who Pays State And Local Taxes Itep